Hyperinflation Is Coming: The Dollar Endgame Part 1- “A New Rome”

Published June 21st, 2021 7:10am PST

Introduction

I am getting increasingly worried about the amount of warning signals that are flashing red for hyperinflation- I believe the process has already begun, as I will lay out in this paper. The first stages of hyperinflation begin slowly, and as this is an exponential process, most people will not grasp the true extent of it until it is too late.

We are at the end of a MASSIVE debt supercycle. This 80-100 year pattern always ends in one of two scenarios- default/restructuring (deflation a la Great Depression) or inflation (in severe cases, hyperinflation (a la Weimar Republic). The United States has been abusing it’s privilege as the World Reserve Currency holder to enforce its political and economic hegemony onto the Third World, specifically by creating massive artificial demand for treasuries/US Dollars, allowing the US to borrow extraordinary amounts of money at extremely low rates for decades, creating a Sword of Damocles that hangs over the global financial system. The massive debt loads have been transferred worldwide, and sovereigns are starting to call our bluff. Systemic risk within the US financial system (from derivatives) has built up to the point that collapse is all but inevitable, and the Federal Reserve has demonstrated it will do whatever it takes to defend legacy finance (banks, broker/dealers, etc) and government solvency, even at the expense of everything else (The US Dollar).

Preface

Inflation: Commonly refers to increase in prices (per Keynesian thinking). However, Inflation in the truest sense is inflation (growth) of the money supply- higher prices are just the RESULT of monetary inflation. (Think, in normal terms, prices really only rise/fall, same with temperatures. (ie Housing prices rose today). The word Inflation refers to a growth in multiple directions (quantity and velocity). Deflation means a contraction of the money supply, which results in falling prices.

Dollarization (Weaponization of the Dollar): The process by which the US government, IMF, World Bank, and other elite organizations force countries to adopt dollar systems and therefore create indirect demand for dollars, supporting its value. (Think Petrodollars).

Central Banks: Generally these are banks that control/monitor the monetary policy of the country they reside in. They are usually owned by private financial institutions (large banks/bank holding firms). They utilize open market operations to stabilize and set market rates. They are called the “Lender of Last Resort” as they are supposed to LEND (not bailout/buy assets) to other banks in a crisis and help defend their currency’s value in international forex markets. CBs are beholden to the “dual mandate” of maintaining price stability (low inflation) and a strong job market (low unemployment)

Monetary Policy: The set of tools that central bankers have to adjust how money moves through the financial system. The main tool they use is quantitative tightening/easing, which basically means selling treasuries or buying treasuries, respectively. *A quick note- bond prices and interest rates move inversely to one another, so when Central banks buy bonds (easing), they lower interest rates; and when they sell bonds (tightening), they increase interest rates.

Fiscal Policy: The actions taken by the government (mainly spending and taxing) to influence macroeconomic conditions. Fiscal policy and monetary policy are supposed to be enacted independently, so as not to allow massive mismanagement of the money supply to lead to extreme conditions (aka high inflation/hyperinflation or deflation)

Prologue:

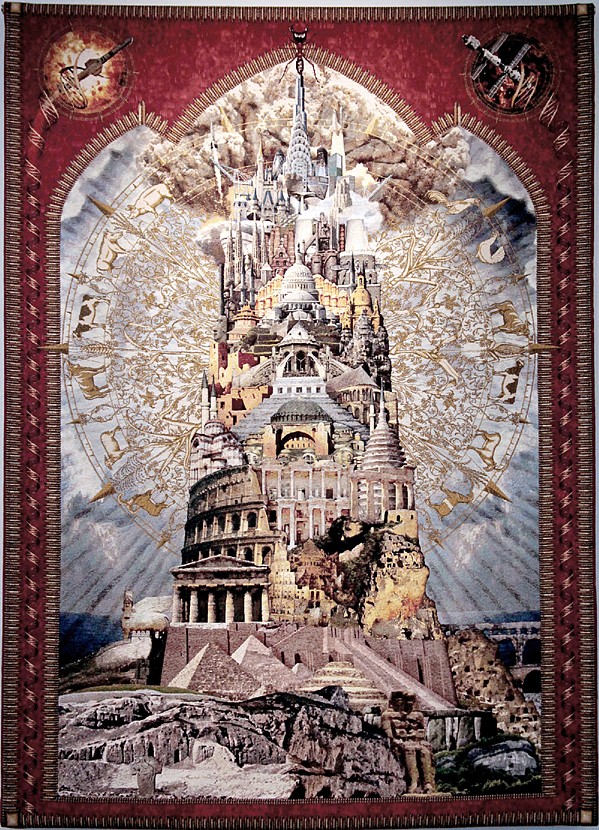

“In their masterwork tapestry entitled “Allegory of the Prisoner’s Dilemma” (pictured in the title image of this post) the artists Diaz Hope and Roth visually depict a great tower of civilization that rests upon a bedrock of human cooperation and competition across history. The artists force us to confront the fact that after 10,000 years of human civilization we are now at a cross-roads. Today we have the highest living standards in human history that co-exists with an ability to destroy our planet ecologically and ourselves through nuclear war.

We are in the greatest period of stability with the largest probabilistic tail risk ever. The majority of Americans have lived their entire lives without ever experiencing a direct war and this is, by all accounts, rare in the history of humankind. Does this mean we are safe? Or does the risk exist in some other form, transmuted and changed by time and space, unseen by most political pundits who brazenly tout perpetual American dominance across our screens?”

The Bretton Woods Agreement

Traditionally, money functions as a medium of exchange, a unit of measurement, and a storehouse for wealth (what is called the three factor definition of money). Money allows people to trade goods and services indirectly, it helps communicate the price of goods (prices written in dollar and cents correspond to a numerical amount in your possession, i.e. in your pocket, purse, or wallet), and it provides individuals with a way to store their wealth in the long-term.

Since the inception of world trade, merchants have attempted to use a single form of money for international settlement. In the 1500s-1700s, the Spanish silver peso (where we derive the $ sign) was the standard- by the 1800s and early 1900s, the British rose to prominence and the Pound (under a gold standard) became the de facto world reserve currency, helping to boost the UK’s military and economic dominance over much of the world. After World War 1, geopolitical power started to shift to the US, and this was cemented in 1944 at Bretton Woods, where the US was designated as the WRC (World Reserve Currency) holder.

In the early fall of 1939, the world had watched in horror as the German blitzkrieg raced through Poland, conquering the entire territory in 35 days. This was no easy task, as the Polish army numbered more than 1,500,000 men, and was thought by military tacticians to be a tough adversary, even for the industrious German war machine. As WWII continued to heat up and country after country fell to the German onslaught, European countries, fretting over possible invasions of their countries and annexation of their gold, started sending massive amounts of their Gold Reserves to the US. At one point, the Federal Reserve held over 50% of all above-ground reserves in the world.

In a global monetary system restrained by a Gold Standard, countries HAVE to have gold reserves in their vaults in order to issue paper currency. The Western European powers all exited the Gold standard via executive acts in the during the dark days of the Great Depression (in Germany’s case, immediately after WW1) and build up to World War II by their respective finance ministers, but the understanding was they would return back to the Gold standard, or at least some form of it, after the chaos had subsided. As WWII wound down, and it became clear that the Allies would win, the Western Powers understood that they would need to come to a new consensus on the creation of a new global monetary and economic system.

Britain, the previous world superpower, was marred by the war, and had seen most of her industrial cities in ruin from the Blitz. France was basically in tatters, with most industrial infrastructure completely obliterated by German and American shelling during various points of the war. The leaders of the Western world looked ahead to a long road of rebuilding and recovery. The new threat of the USSR loomed heavy on the horizon, as the Iron Curtain was already taking shape within the territories re-conquered by the hordes of Red Army. Realizing that it was unsafe to send the gold back from the US, they understood that a post-war economic system would need a new World Reserve Currency. The US was the de-facto choice as it had massive reserves and huge lending capacity due to its untouched infrastructure and incredibly productive economy.

At Bretton Woods, the consortium of nations assented to an agreement whereby the Dollar would become the WRC and the participating nations would synchronize monetary policy to avoid competitive devaluation. In summary, they could still redeem dollars for Gold at a fixed rate of $35 an oz, a hard redemption peg which the U.S would defend. Thus they entered into a quasi- Gold standard, where citizens and private corporations could NOT redeem dollars for Gold (due to the Gold Reserve Act , c. 1934), but sovereign governments (Central banks) could still redeem dollars for gold. Since their currencies (like the Franc and Pound) were pegged to the Dollar, and the Dollar pegged to gold, all countries remained connected indirectly to a gold standard, stabilizing their currency conversion rate to each other and limiting local governments’ ability to print and spend recklessly.

For a few decades, this system worked well enough. US economic growth spurred European rebuilding, and world trade continued to increase. Cracks started to appear during the Guns and Butter era of the 1960’s, when Vietnam War spending and Johnson’s Great Society programs spurred a new era of fiscal profligacy. The US started borrowing massively, and dollars in the form of Treasuries started stacking up in foreign Central Banks reserve accounts.

Then-French President Charles De Gaulle did the calculus and realized in 1965 that the US had issued far too many dollars, even considering the massive gold reserves they had, to ever redeem all dollars for gold (remember naked shorting more shares than exist? -same idea here). He laid out this argument in his infamous Criterion Speech and began aggressively redeeming dollars for gold. The global “run on the dollar” had already begun, but the process accelerated after his seminal address, as every large sovereign turned in their dollars for bullion, and the US Treasury was forced to start massively exporting gold. Backing the sovereign government’s actions were fiscal and monetary strategists getting more and more worried that the US would not have enough gold to redeem their dollars, and they would be left holding a bag of worthless paper dollars, backed by nothing but promises. The outward flow of gold quickly became a deluge, and policymakers at all levels of Treasury and the State department started to worry.

Nearing a coming dollar solvency crisis, Richard Nixon announced on August 15th, 1971 that he was closing the gold window, effectively barring all countries from current and future gold redemptions. Money ceased to be based on the gold in the Treasury vaults, and instead was now completely unbacked, based solely on government decree, or fiat. Fixed wage and price controls were created, inflation skyrocketed, and unemployment spiked.

Nixon’s speech was not received as well internationally as it was in the United States. Many in the international community interpreted Nixon’s plan as a unilateral act. In response, the Group of Ten (G-10) industrialized democracies decided on new exchange rates that centered on a devalued dollar in what became known as the Smithsonian Agreement. That plan went into effect in Dec. 1971, but it proved unsuccessful. Beginning in Feb. 1973, speculative market pressure caused the USD to devalue and led to a series of exchange parities.

Amid still-heavy pressure on the dollar in March of that year, the G–10 implemented a strategy that called for six European members to tie their currencies together and jointly float them against the dollar. That decision essentially brought an end to the fixed exchange rate system established by Bretton Woods. This crisis came to be known as the “Nixon Shock” and the DXY (US dollar index) began to fall in global markets.

This crisis came out of the blue for most members of the administration. According to Keynesian economists, stagflation was literally impossible, as it was a violation of the Philips Curve principle, where Unemployment and Inflation were inversely correlated, thus inflation should theoretically be decreasing as the recession worsened and unemployment climbed through 1973-1975.

Phillips Curve Explained:

Low Unemployment>Lots of jobs/high demand for labor.

Thus, more workers are employed, and wages rise>putting more money in more people’s pockets.

These people go out and buy beanie babies, toasters, and bananas (what economist John Maynard Keynes called aggregate demand) and this higher demand leads to higher prices for goods and services. This shows up as inflation.

Consider the opposite- high unemployment>fewer jobs>less money for people

Less demand for goods and services> lower inflation

Keynesian economists treated this curve as a law of nature, rather than a general rule. We see exceptions to this rule everywhere- Argentina is a prime example, where they have persistently high unemployment AND high inflation. This phenomenon is called stagflation, and is evidence of inflationary pressures so strong that they overcome the deflationary force of high unemployment. These economists were utterly blindsided by the emergence of stagflation.

After the closing of the gold window in 1971, the crisis spread, inflation kept climbing, and other sovereigns began contemplating devaluing their currencies as their only peg, the US dollar, was now unmoored and looked to be heading to disaster. US exports started climbing (cheaper dollar, foreigners could now import stuff to their countries), straining export economies and sparking talks of a currency war. Knowing they had to do something to stop the bleeding, the Nixon administration, at the direction of Henry Kissinger, made a secret deal with OPEC, creating what is now called the Petrodollar system. This article summarizes it best:

Petrodollars had been around since the late 1940s, but only with a few suppliers. Petrodollars are U.S. dollars paid to an oil-exporting country for the sale of the commodity. Put simply, the petrodollar system is an exchange of oil for U.S. dollars between countries that buy oil and those that produce it. By forcing the majority of the oil producers in the world to price contracts in dollars, it created artificial demand for dollars, helping to support US dollar value on foreign exchange markets. The petrodollar system creates surpluses for oil producers, which lead to large U.S. dollar reserves for oil exporters, which need to be recycled, meaning they can be channeled into loans or direct investment back in the United States.

It still wasn’t enough. Inflation, like many things, had inertia, and the oil shocks caused by the Yom Kippur War and other geo-political events continued to strain the economy through the 1970’s.

Running out of road, monetary policymakers finally decided to employ the nuclear option. Paul Volcker, the new Federal Reserve Chairman selected in 1979, knew that it was imperative to break the back of inflation to preserve the global economic system. That year, inflation was spiking well above 10%, with no end in sight. He decided to do something about it.

By hiking interest rates aggressively, consumer credit lending slowed, mortgages became more expensive to finance, and corporate debt became more expensive to borrow. Foreign companies that had been dumping US dollar holdings as inflation had risen now had good reason to keep their funds vested in US accounts. When the Petrodollar system, which had started taking shape in ‘73 was completed in March 1979 under the US-Saudi Joint Commission, the dollar finally began to stabilize. The worst of the crisis was over. Volcker had to keep interest rates elevated well above 8% for most of the decade, to shore up support for the dollar and assure foreign creditors that the Fed would do whatever it takes to defend the value of the dollar in the future. These absurdly high interest rates put a brake to US government borrowing, at least for a few years. Foreign creditors breathed a sigh of relief as they saw that the Fed would go to extreme lengths to preserve the value of the dollar and ensure that Treasury bonds paid back their principal + interest in real terms.

Over the next 40 years, the United States and most of the developed world saw a prolonged period of economic growth and global trade. Fiat money became the norm, and creditors accepted the new paradigm, with it’s new risk of inflation/devaluation (under the gold standard, current account deficits, and thus inflation risk, was self-stabilizing). The Global Monetary system now consisted of free-floating fiat currencies, liberated from the fetters of the gold system.

Dollar Hegemony

Ok, let’s go over this for a second. Let us say you are the President of a country like Liberia, a small West African nation, looking to enter global trade. You go talk to the International Monetary Fund, whose economists tell you in order to be a modern economy you need to have your own currency. Thus, you need a Central Bank to print your own currency (LD), which will be used as legal tender, enforced by your government. Your Central bank will act as a lender of last resort for all the commercial and investment banks in your country, and will be responsible for stabilizing monetary policy.

But, there’s an issue-the economists tell you that you CANNOT have your Central Bank store up your own currency as the majority of its foreign exchange reserves. Why? Well, if your currency comes under attack in the global Forex markets, you will have to defend it. If your currency trade value is too high, it’s easy to fight- you just print your own currency and buy Euros (EU) or Dollars (USD), flooding the market with your currency and taking other currencies out of the market- “devaluing your currency” . However, if the inverse is true, and your currency is losing value in the market, printing more to flood the market will only make it worse. You need a stable currency, like bullets in the chamber, to utilize to buy your currency at the market rate, to support its value and drive it back up. This form of currency defense is called “defending the peg” (Post-1971, the peg is floating, so it’s more of a range, but it’s still referred to loosely as a peg).

This exact phenomenon played out during the Asian Financial Crisis of 1997, a classic case study in global monetary crises. Thailand had grown rapidly as world trade boomed in the 1980s and 90s, and its corporate and real estate sectors took on massive amounts of debt. A massive real estate and financial bubble formed (does this sound familiar)? Soon, the bubble started to pop:

Thailand’s hand was forced, and the Thai Central Bank decided to devalue its currency relative to the US dollar. This development, which followed months of speculative downward pressures on their currency that had substantially depleted Thailand’s official foreign exchange reserves, marked the beginning of a deep financial crisis across much of East Asia. In subsequent months, Thailand’s currency, equity, and property markets weakened further as its difficulties evolved into a twin balance-of-payments and banking crisis. Malaysia, the Philippines, and Indonesia also allowed their currencies to weaken substantially in the face of market pressures, with Indonesia gradually falling into a multifaceted financial and political crisis.

As the president of Liberia, you see what can happen when a country, especially a small third-world country, doesn’t have enough dollar reserves to defend its own currency. Rippling currency devaluations, inflation, social and political unrest, widening economic inequality- the beginning of a death spiral of a country if you aren’t careful. So, you tell the IMF that you agree to their terms. They impress upon you that you need to get your bank to buy up some other stable currency to hold as reserves, to defend against this very scenario. As the US dollar is the World Reserve Currency, you’re going to hold it as the majority of your reserve position. We’ve established the need for a small country to hold another currency on their balance sheet. If ONE small country does this, there is little impact on the US Dollar. However, under the current system, virtually EVERY country has a central bank, and they all use the Dollar as their main reserve currency. This creates MASSIVE buying pressure on Treasuries and USDs. Using Liberia as an example, the process works like this:

THIS is what French Finance Minister Valéry Giscard d’Estaing meant when during the 1960’s he had contemptuously called this benefit the US enjoyed le privilège exorbitant, or the “Exorbitant privilege”. He understood that the United States would never face a Balance of Payments (currency) crisis (*AS LONG AS THE USD IS THE WORLD RESERVE CURRENCY*) due to forced buying of Treasuries (from Central Banks) and Dollars (from Petrodollar system). The US could borrow cheaply, spend lavishly, and not pay for it immediately. Instead, the payment for this privilege would build up in the form of debt and dollars overseas, held by foreigners all around the world. One day, the Piper HAS to be paid- but as long as the music is playing, and the punchbowl is out, everyone gets to party, dance & drink to their hearts’ content, and the US can remain the belle of the ball. Effectively, the US can print money, and get real goods. This means we can import consumer products for cheap, and the inflation we create gets exported to other countries. (ONE of the reasons why developing countries tend to have higher inflation). Another way to explain it:

As it is the WRC, other countries’ Central Banks NEED to have US dollars on their balance sheet. Thus, the US has to run persistent current account deficits in order to send out more dollars to the global system, on net, than it receives back. A major byproduct is constant large and increasing trade deficits for the WRC holder (in a fiat money system). This is what is known as Triffin’s dilemma: the WRC is HAS to run constant trade deficits. There are no immediate negative impacts, but in the long run this process is unsustainable, as the WRC country becomes unproductive (ever wonder why US manufacturing left) because the system forces the WRC holder to be a net importer. As world trade grows, the current account deficit/trade deficit grows, and the benefits (more goods to the US) and drawbacks (more dollars build up overseas) increase over time. Eventually the imbalance becomes so great that something snaps, just like it did for the Pound post WWI, where policymakers chose the route of deflation in 1921, creating a Great depression for the UK long before the US ever experienced it.

This is why I laughed out loud when I heard Trump rail against our trade deficits in one of the 2016 presidential debates. He clearly did not understand how our system works, and that this issue was beneficial in the short term, but detrimental in the long term. Our trade deficits were symptoms of our system working exactly as intended. In fact, a large part of the reason why he was elected was the de-industrialization of the American heartland, where loss of economic vitality from manufacturing jobs was leading to rampant drug abuse, depression, and societal decay. I knew this process of deindustrialization would only get worse with time, and nothing he did (short of taking us off the WRC status) would change that. (Not political, other politicians say the same shit. They just don’t understand the very system in which we operate).

Fast forward to today- After decades of this process playing out, Foreign Central Banks collectively hold huge amounts of Forex reserves, as you can see below where countries are sized depending on their reserves of foreign currency exchange assets:

The majority of these reserves are held in dollars, mainly in the form of Treasuries, T-bills, and other US government debt. Furthermore, the US Dollar continues to dominate global trade through the SWIFT network (Society for Worldwide Interbank Financial Telecommunication). SWIFT is a payments system used by multinational banks, institutions, and corporations to settle trade worldwide. USD is the preferred payment method within the system, thus forcing other countries to adopt the dollar in international trade. This is one of the results of the petrodollar system we described earlier. Petrodollars originally were exclusively used to refer to oil contracts priced in USD from Saudi Arabia, but over time the name grew to mean any oil contract, transacted by non-US countries, using the US Dollar as the denomination.

When Chile and South Africa trade copper, for example, they have to transact in dollars, because a SWIFT member bank in South Africa will not accept Chilean Pesos as payment, as there is a smaller, less liquid market for it and it doesn’t want to take a trading loss when converting to a more usable currency. The contract itself is priced in USD, so if that merchant bank wants to sell it, they can quickly find a buyer. In fact, SWIFT itself published a report in 2014, and found that the USD accounts for almost 80% of all world trade! (see top left)

This process is called dollarization, whereby the dollar is used as the medium of exchange for a contract, in place of some other currency, even between non-US trading partners (Iran and China for example). Dollarization (capital D) of a country occurs when a government switches from managing their own currency to just using the US dollar for trade settlement and tax revenue- like Ecuador, El Salvador, and Panama have done. The US Dollar reserves from the petro-dollar system show up on the balance sheets of these overseas financial institutions; they are called Euro-Dollars, and these USD denominated deposits are not under the jurisdiction of the Treasury or Federal Reserve. If you want to read a brief history of the Euro-dollar market, check out this paper from the Federal Reserve bank of St. Louis here. In 2016, the total value of the Eurodollar Market was estimated to be around 13.83 Trillion.

Through this process, the United States was able to become the largest and most dominant military force in the history of man, able to fight simultaneous two-theater wars with overseas supply lines. The Treasury could borrow and spend, unimpeded by the normal constraints of market discipline that were hoisted on other countries. Despite not declaring war since 1941, the US has been in a state of near-continuous warfare.

At every turn, the US defended this system at all costs, even going so far as to directly invade and occupy the Middle East in the Gulf War in 1991 and the Iraq/Afghanistan War (2001-Present). As a result there are over 800 US military bases around the world, in locales ranging from Turkey to Japan. American institutions like the Senate, Presidency, and Courts were modeled after their Roman antecedents, to the point that the American symbol, the Eagle, is the spitting image of the Roman Aquila adorned on the Standard of the centurions.

Most scholars tout the story of Rome as a tale of triumphalism; of valiant centurions battling in the steppes of Asia, of brilliant generals laying traps for enemy armies, of scheming senators fighting battles of political intrigue, and of a sophisticated and well-functioning empire that harnessed engineering to create marvels such as the Colosseum and the Roman Aqueducts.

More sober historians, however, point out that the story of Rome is one that also echoes a warning through the annals of history. A complex society, with mighty political, legal, and financial institutions, supported by a massive military, fell not to a crushing enemy invasion, but to collapse and decay from within. An elite ruling class, detached from the realities of daily life of the citizens, oversaw an empire with growing income inequality, environmental degradation, political corruption, social deterioration, and economic despair, and did nothing to stop it. The Roman Treasury, facing insurmountable debts from years of fruitless war, started “clipping coins” an early form of currency debasement that led to the Roman denarii losing 25% of it’s value every year. This eventually led to uprisings in Roman provinces and the Sacking of Rome– the coup de grace, the final nail in the coffin for what had become the decadent Western Roman empire.

Conclusion

If the US loses World Reserve Currency status, two things happen. 1) Foreign central banks start massively dumping their huge Treasury/Dollar debt positions and 2) SWIFT member banks who hold USDs for cross-border payments (EuroDollars) decide to dump them as they switch to a new World Reserve Currency.

This is the one of the many Swords of Damocles hanging over the global financial system. The unraveling of these massive currency positions would truly be catastrophic. Interest rates could effectively jump to +30% or more overnight, creating an immediate solvency crisis for the US Government and most banks, corporations, and state governments who rely on low interest rate borrowing. DXY would be whipsawed violently upwards for a period of time before being forced downward by massive selling pressure from the Eurodollar market. Other currencies would be pulled higher and then lower in volatile moves matching the worst days of the early Nixon crisis. But, this is only part of the story. We’ve gone over a brief history of the Bretton Woods system, and it’s transformation to a complete fiat money system starting in 1971. The US as a World Reserve Currency holder is allowed to borrow almost indefinitely without immediate consequence, but this creates massive amounts of US dollar debts overseas. The last time global creditors started to lose faith in the US dollar, we saw massive inflation, unemployment, and stagnation in the US, in a period of rapid demographic and economic growth in the rest of the world. If creditors become worried again, and signs are showing up that they are (more on this in PT4) the results could be catastrophic.

Nothing on this Post constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product, transaction or investment strategy is suitable for any specific person. From reading my Post I cannot assess anything about your personal circumstances, your finances, or your goals and objectives, all of which are unique to you, so any opinions or information contained on this Post are just that – an opinion or information. Please consult a financial professional if you seek advice.

‘The Dollar Endgame’ series is much more than DD aimed at a cause. The research is sound. The opinion is minimal. The economic histories, concepts, and mechanisms are easy to understand by Karens, Carls, John Q. and Jane E. Publics. Thank You for spending your time lacing up the pages of diverse media into the Encyclopedieverything. I had not realized my own world-view lense needed a dynamic prescription that is self ground.

Realizing how irresponsible complacency led me to thinking that compromising with myself was normal and acceped practice, even with core virtues/values like freedom and ownership; My personal (absolute) authority of them, I was giving away…for free… and without much thought. The only currency that somehow could be traded with freedom is time. Thank you again for your continued investment and the part it has, does, and will play in my journey.

Aww…whoami fugginkiddin. I just want to be mentioned in the movie, or have my name in the screenshot of whatever our new chat gpt overlords post and make famous.

You should add stand up comedian to your journey, because you self reflective comment is pretty fuggin funny!!